If you already have children attending early learning (child care) services, or you are in the process of enrolling your child/children in an early learning service, you will need to register for the new Child Care Subsidy (CCS).

Here’s what you need to do:

1. Create a Centrelink online account

(if you don’t have one already - families already receiving the CCB and/or CCR should already have one)

You will need your CRN, your child’s CRN and your last payment amount from Centrelink.

(If you don’t have a CRN you will need to telephone Centrelink on 136 150 or visit a Centrelink office.)

2. Create a MyGov account online

(if you don’t have one already - families already receiving the CCB and/or CCR should already have one)

3A. FOR FAMILIES ENROLLING IN ECEC SERVICES FOR THE FIRST TIME - Apply for the Child Care Subsidy (via MyGov)

When logged into your MyGov account, you see Centrelink listed under “Your services” - click on “Centrelink”.

You will then see a blue box at the bottom of the screen which says “Complete your Child Care Subsidy assessment” – click on this box.

You will then see a page which says: “Your assessment for Child Care Subsidy has been started."

To complete:

1/ Family income assessment

2/ Activity test

You can complete both of these items in the one sitting, or you can complete them one at a time. We recommend you do them both at the same time if possible, to avoid the risk of forgetting to get back to this process at another time.

3/ Confirm enrolment

Once your early learning service/centre has notified Centrelink of your child's impending enrolment, you will receive a notification through MyGov which should accurately reflect the attendance details you have agreed to at their centre for your child.

You

must confirm that this information is correct via the prompts in MyGov before subsidies will be paid on your behalf to the early learning service.

OR

3B. FOR FAMILIES ALREADY RECEIVING CCB AND/OR CCR - Provide further information (via MyGov)

Log into your MyGov account and follow the prompts to provide your activity and income estimate for the 2018-19 financial year, provide your activity and income estimate for the 2018-19 financial year and confirm other details.

You can complete all three of these items in the one sitting, or you can complete them one at a time. We recommend you do them all at the same time if possible, to avoid the risk of forgetting to get back to this process at another time.

Upon completing all three items under the Child Care Subsidy assessment, you should be presented with an online Enrolment Summary.

This will display a summary of recent enrolments for your child at your chosen early learning service/centre. You will need to action the unconfirmed enrolment by hitting the review button.

For ALL FAMILIES once logged into MyGov

Family income assessment

You will be asked to provide your family income estimate for the 2018/2019 financial year.

If you over estimate (meaning you don’t end up earning as much as you have estimated to Centrelink) you will receive a payment at the end of financial year.

If you underestimate (meaning you end up earning more than you have estimated to Centrelink), the amount owed will be deducted from the withheld amount of CCS, or you may have to repay some of the subsidy you have received.

Activity test

The

activity test asks you to provide details of your family’s activities such as paid work, study, work experience, running a business, looking for work or caring for a person with a disability, from 2nd July 2018.

The details you provide in the activity test will determine the number of hours of subsidised early learning (child care) services to which your family is entitled.

You need to understand what sort of activities are included in the activity test to ensure that you are correctly reporting all eligible family activities and claiming the full amount of subsidy.

In two parent families both parents, unless exempt, must meet the activity test. In the case where both parents meet different steps of the activity test, the parent with the lowest entitlement will determine the hours of subsidised care for the child.

|

Put simply the more activity your family undertakes, the more hours of subsidised care you can claim, so it’s important that you don’t underestimate their anticipated hours or activity.

If your family is doing multiple activities, these can also be combined to meet the activity test. For example, if a parent works and studies, both activities will be included.

The travel time between the early learning service and the family member’s place of work, training, study, or other recognised activity will also be included.

The hours of activity your family undertakes do not need to coincide with the hours that you use early learning services. For example, if your family works over the weekend, you can still use those hours to calculate how many hours of the Child Care Subsidy you are entitled to during the week.

|

Things you need to know before filling out the test

There is a broad range of recognised activities that you can include in the activity test:

- Paid work

This includes paid leave, paid or unpaid parental and maternity leave if this is a condition of employment, or being self-employed.

- Study and training

This includes being enrolled in an approved course of education or study, or being enrolled in training courses for the purpose of improving the individual's work skills or employment prospects.

- Unpaid work

This includes unpaid work in the family business which is owned by a member of the individual’s immediate family, actively setting up a business, or unpaid work experience or internships.

- Actively looking for work

This includes looking for job vacancies, preparing résumés and job applications, contacting potential employers, or preparing for and attending job interviews.

- Setting up a business

This includes obtaining finance, advice and support, attending and organising meetings and networking, developing business and marketing plans.

- Volunteering

This includes voluntary work to improve work skills or employment prospects, voluntary work for a charitable, welfare or community organisation, voluntary work for a school, preschool or a centre-based day care service (if the work directly supports the learning and development of the children at the school, preschool or service e.g. reading to children).

Note: Being on the Parents and Citizens Committee, working in the school canteen, or coaching children’s soccer team are considered parental duties and would not be considered as a recognised volunteer activity.

If your family takes on a number of different types of activities, these can also be combined to meet the activity test. For example, if a parent works and studies, both activities should be included.

- Travel time and break times

You should include break times as well as the travel time between the child care service and the family member’s place of work, training, study, or other recognised activity in your activity hours total.

For example, in response to the question “How many hours per fortnight do you work?” you should include:

- the hours that you are paid to work;

- your lunch break hours; and

- the time it takes to travel from your child’s day care to your place of work.

For example if you worked 3 x 8hr days with an hour lunch break each day and your child’s early learning centre was 30 minute drive you would have 3 x 8hrs(paid employment) + 3 x 1hr (lunch break) + 2 x 30 min trips per day x 3 days to childcare = 30 hrs per week or 60hrs per fortnight.

This also applies to study and volunteer work.

- Maternity or parental leave

If a family member is on paid or unpaid maternity or parental leave and this is a condition of their employment, this also classifies as recognised activity. The hours of activity will be the same as what they were immediately prior to commencing parental leave.

This means that if a parent was working full time then he/she is still considered to be a full-time employee while on parental leave.

- Irregular work hours (eg. Casual labour) or running a small business

If you or your partner work irregular hours or run a small businesses, you can estimate this activity over a three month period. Be sure to count the highest number of hours that you could possibly work in that fortnight.

The estimate should be for the highest number of hours anticipated, even if that number of hours isn’t required every day. This provides the flexibility to pick up additional hours of work and know that care will be available. If those irregular hours change, you can update them online as required via your myGov account.

- Unpaid work

Unpaid work in a family business can include cleaning on a weekend, completing administrative tasks etc.

What if your activities don’t meet the activity test?

Other activities that do not fall into the recognised activity categories will be assessed by the Government on a case-by-case basis. Families will need to contact Centrelink directly to find out if the activity is supported under the Child Care Subsidy.

If the family earns $66,958 or less a year, and does not meet the Activity Test, they will be still able to access up to 24 hours of subsided care per child per fortnight.

|

Kindergarten/Preschool programs are exempt from the activity test

Families are entitled to 36 hours of subsidised care per fortnight if the child attends a kindergarten or preschool program at a centre-based day care (ie. long day care) in the year that is two years before grade one of school.

|

The Child Care Subsidy can be backdated up to 28 days prior to the date the Child Care Subsidy claim was submitted or 2 July 2018, whichever is later.

4. Find out your new Child Care Subsidy rate and eligible hours per fortnight

After you have completed all of the above steps in MyGov, it will take about two weeks for the system to produce your eligible subsidy level.

In the meantime you may wish to get a quick estimate using our

CCS calculator.

After a week or so you should then

revisit your MyGov account and select the Centrelink portal.

In the top left corner you will see a drop-down box - you should select "Child Care Subsidy (CCS)", then select "Child Care Subsidy Summary".

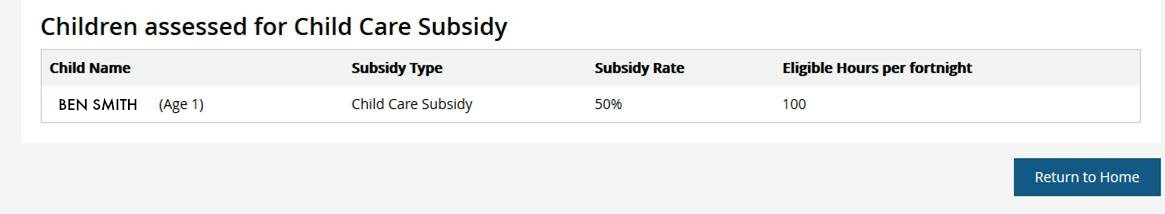

There you should see your child's(children's) name(s), Subsidy type (CCS), Subsidy rate (%) and Eligible hours per fortnight eg 100 hours.

(Below is an image of how this will appear in MyGov.)

Once you have this information, you should advise your Nominated Supervisor (Manager/Director) at your early learning centre of your subsidy rate and eligible hours as soon as you can to discuss possible attendance patterns that best work for you.

5. Find a suitable early learning (child care) service provider

(if you don't have one already)

Find a suitable child care service provider that meets your family’s needs, and enter into a written agreement with this service (likely to be captured in an enrolment form, although this may vary from service to service).

The service provider will formally advise Centrelink of the details of that agreed care arrangement, which will trigger a request to you from Centrelink (through MyGov) asking you to verify the information provided by the service.

It is important to note that no subsidy will be paid unless you have completed this call to action and the service is likely to charge you the full fee, as they would be unaware of the level of subsidy you qualify for. Every time you permanently change your care arrangements, this process will need to be repeated.

Your service is required to give you a “fortnightly statement of entitlement” which sets out your total fortnightly fee, your fortnightly Child Care Subsidy amount, and the resulting out of pocket fee which you will be required to pay.

Where can you get more information about the new Child Care Subsidy (CCS)?

The Department of Education and Training has published a list of frequently asked questions to help families understand the new package. These are available

here.

Families can now calculate the level of fortnightly financial support they can expect to receive using ACA's

Child Care Subsidy Calculator.

This online tool will ask families a set of questions about their circumstances, including the hourly rate of their particular early learning service, to provide an estimate of their fortnightly Child Care Subsidy.

Please note: In most cases, you will need to know your early learning service's hourly rate before using this tool.

Please speak with your early learning service directly to determine the hourly rate.

If you have any further questions about these upcoming changes, talk to your child care service or contact the Centrelink Family and Parent line on 136 150 (Mon – Fri 8am – 8pm).