As all ECEC service providers would probably now be aware, the new Child Care Subsidy package, which will include a new payment known as the Child Care Subsidy (CCS), is due to be fully implemented on 2 July this year.

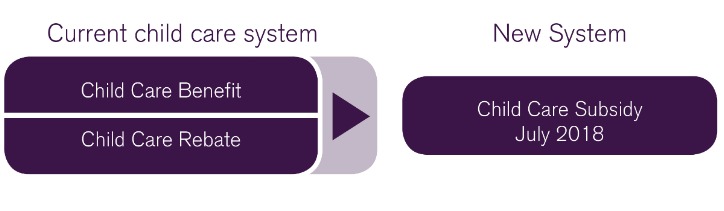

The CCS will replace the Child Care Benefit (CCB) and the Child Care Rebate (CCR) and will be paid directly to Early Childhood Education and Care (ECEC) services on behalf of families.

As the changes surrounding this new package will affect more than 17,000 service providers across Australia and over 1.2 million families using ECEC services, it’s important that all ECEC service providers and their families understand what they need to do between now and July to ensure a successful transition to the new system.

How will the new Child Care Subsidy (CCS) affect ECEC services?

The new child care package will bring about a number of substantial changes to the way ECEC services operate, and the way they engage with their families.

ECEC service operators will experience changes to their financial and operating models due to:

- Potential affordability and accessibility impacts for families

- New reporting requirements, enrolment processes and IT system changes

- A need to train staff to handle new processes plus enquiries from families

How will the new Child Care Subsidy (CCS) impact your families?

Under the new CCS, many working families will receive greater financial support to assist them in paying for child care services. However, some families will receive a lower subsidy, and some families will no longer be eligible for any subsidy at all.

The factors that will determine each family’s level of CCS support include their combined family income, the combined activity level of both parents (i.e. hours of paid work, self-employed work, approved training or voluntary work, to be assessed via an “activity test” ) and the type of child care services they use.

You can review the percentage of subsidy families will be eligible for in relation to their combined income on the Department of Education and Training website.

There is also an online Child Care Subsidy estimator, which allows families to work out their level of subsidy under the new CCS. The tool asks users for details such as family income before tax, the number of hours each parent works a fortnight and how many children they have. Families can access the estimator here.

Families eligible for the CCS will pay any difference between the actual fee charged and the subsidy paid on their behalf. The Australian Government has also stated that provisions of the package will be indexed before implementation in July 2018.

You may wish to share the following educational resources with your families to assist them in learning about the new CCS:

- ACA Fact Sheet For Families

- DET Child Care Subsidy Estimator

- DET Child Care Subsidy Family Webcast

- DET Child Care Subsidy Family FAQ’s

In addition to those families that are exempt from the Activity Test, the Child Care Safety Net comprises of three components:

- Additional Child Care Subsidy (a top-up payment in addition to the CCS

- Community Child Care Fund (grant funding that goes directly to ECEC services for the benefit of disadvantaged and vulnerable families). This also includes Connected Beginnings funding to help prepare Aboriginal and/or Torres Strait Islander children in areas of high need to prepare for school, by supporting Indigenous pregnant women, and Indigenous children from birth to school age)

- Inclusion Support Programme (child care funding for children with additional needs).

ECEC services and families can access further information about the Child Care Safety Net here.

ECEC services - What you need to think about RIGHT NOW

How you package your services

Services may consider different session types or models that suit the needs of their communities but are not obligated to do so. If they do choose to offer more varied session structures, service providers will need to determine the impacts of “sessional care” (i.e. 4-6 hour daily sessions) on their operations and parental access, along with their financial viability.

To assist ECEC services in considering these impacts, the Department of Education and Training (DET) has produced a Simple Scenario Analysis Tool, which allows an analysis of the current state of your service, and a comparison of the change in net result if you change inputs, such as the number of educators per day, hours of operation per day or the average number of children per week. You can access this tool here.

ACA is in the process of developing a CCS session flexibility and viability tool , which will allow ECEC service providers to explore their options in terms of financial modelling under the new regime. This tool is expected to be launched in April/May. ACA members will receive an email from their local state body when the tool becomes available.

New technology platform for ECEC services

There is a new IT system – the Child Care Subsidy System (CCSS) – which will replace CCMS and will be used to administer payment of the new subsidy. To access the CCSS key service personnel will need to register in an online authentication system called PRODA (Provider Digital Access), which features a two-step verification process to give individuals secure access to Government online services. PRODA is also used for access to other government services such as the National Disability Insurance Scheme (NDIS).

Using PRODA

ECEC services Approved Providers/Nominated Supervisors, along with any other designated staff, will need to register with PRODA as an individual to create an account. You will need to set up a username and password and provide three identity documents (ie. items such as your Medicare card, driver's licence, Australian passport).

This registration will allow you to access the CCSS.

All relevant parties are encouraged to register with PRODA as soon as possible.

You can do this here.

New CCMS Software – An Individual Decision For ECEC services

All CCMS software providers should by now be in the process of developing a revised software product that will work and comply with the Government’s new IT system, the CCSS, or informing their customers that they will not be able to provide a compliant product.

With such a significant change due to take effect in July this year, it is vitally important that you are aware of how your current software provider is delivering on this project and their expected timelines.

ACA strongly urges all ECEC services to start the conversation with their existing CCMS software provider, to find out whether they are building a new CCSS compatible product, whether there are any new costs or requirements, and what their expected timelines are. You may also wish to explore other software providers on the market, to ensure that you are well informed when making a decision.

You can visit the Department of Education and Training’s list of registered CCMS software providers here.

One of the new requirements under family assistance law is for services to log actual attendance time of children at your service. This can be done via an electronic solution, or entered manually into your software. Therefore, it is important to consider the practical implications of installing hardware and having access to such systems from your current software provider. It is also important that you consider the challenges with transitioning families to a new system in the lead up to the introduction of these changes.

Education and training of ECEC services staff

To ensure a smooth transition across to the new Child Care Subsidy (CCS), ECEC services will need to prepare their staff for the upcoming changes, both from an operational perspective, as well as to help them successfully explain the new requirements when engaging with families.

ACA encourages ECEC services to start thinking about how to educate and train staff about the new changes, and ensure that they are aware of:

- the new CCS and its impact on operations

- the changes in subsidy levels for some families

- the option to introduce sessional care for any families with an income of $65,710 or less a year

- the need to register with PRODA (if delegated to do so)

- the Government’s existing online materials that have been produced to help both families and ECEC services learn about the new CCS and prepare for the upcoming changes

- the provider roadshows to be conducted by the Department of Education and Training in March – You can register for a face to face or webinar session here.

Australian Government Transition To-do List for ECEC services

The Department of Education and Training regularly updates the information for service providers webpage on their website, including a transition to-do list available here.

Further ACA Educational Materials about the new Child Care Subsidy (CCS)

ACA has created a webpage of information resources regarding the New Child Care Subsidy (CCS), which we will continue updating with new materials as they become available.

You can visit this webpage here.