Early access to retirement savings should only occur under extreme circumstances

At first glance, accessing early release superannuation may seem convenient. But it risks undermining your planned retirement income and should only be a last resort.

The Federal Government recently announced it would allow those whose employment has been affected by COVID-19 to access some of their superannuation balances early.

Under the new rules, workers whose income is reduced by at least 20% or those who have lost thier job due to the COVID-19 outbreak can access up to $20,000 of their super.

|

That first $10,000 is available between mid-April and 30 June 2020, and the second $10,000 is available after 1 July 2020 for around three months. |

There is no doubt that the next few months are going to be difficult for many of us. However, we all have a role to play to adapt to the changes we are facing and understand the best option for each of us, to cushion the impact of what is happening. This means considering our financial needs now and in the future.

Financial modelling shows that while the early release of superannuation may give some Australians breathing room, it will have a significant impact on retirement savings.

Be Super Smart: Accessing your superannuation to help with challenges of COVID-19

Australians who take out $20,000 from their super-annuation due to the COVID-19 economic slowdown will sacrifice nearly $79,000 from their retirement nest eggs, according to new Rainmaker modelling*.

There are also real issues to consider when divesting from your super when the market’s in the condition that it is now.

Accessing your super at the bottom of the market may mean losing hard-earned retirement savings. We encourage all our members to carefully weigh up all their options, before dipping into their retirement savings.

|

If you do decide to withdraw your super |

Child Care Super is here to help

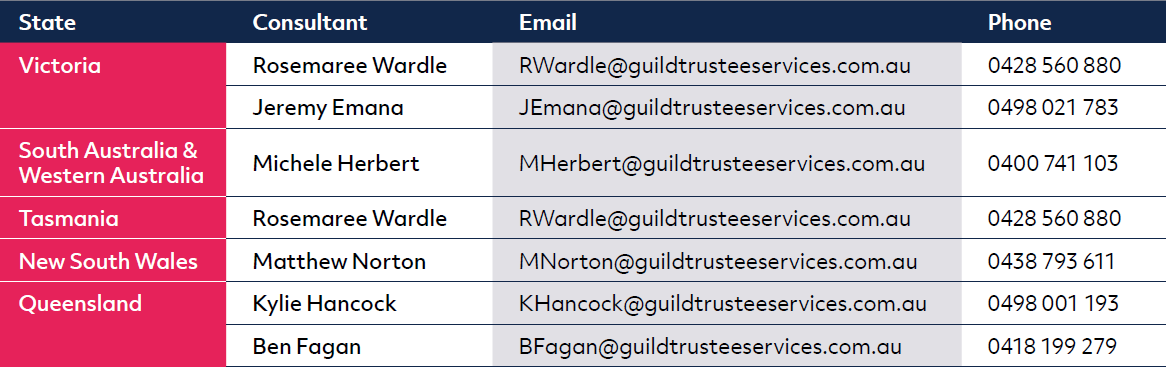

If you have any questions or concerns about this issue, please contact Child Care Super.

Please understand that Child Care Super's consultants cannot provide you with personal financial advice and cannot provide general financial advice on any other financial product.

For information on insurance in super, visit childcaresuper.com.au/covid-19

You can follow Child Care Super on Facebook here.

*Source: Kanika Sood at Financialstandard.com.au: https://www.financialstandard.com.au/news/early-release-to-bite-retirement-hard-156648742

This information was current at the time of publishing. Guild Trustee Services Pty Ltd. ABN 84 068 826 728. AFSL 233815. Trustee for the Guild Retirement Fund (which includes Child Care Super) ABN 22 599 554 834. RSE Licence Number L0000611. This document contains general advice only and doesn’t take into account what you currently have, want and need for your personal circumstances. It is important for you to consider these matters and read the Product Disclosure Statement (PDS) before you make a decision about a superannuation product. You can get a copy of the PDS by calling 1800 060 215.