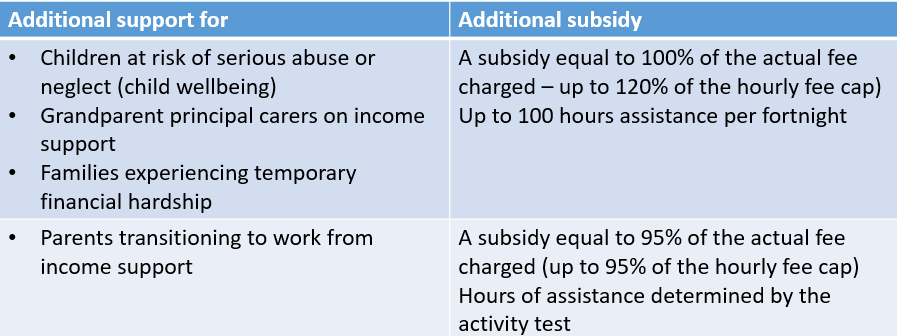

Under the new Child Care Subsidy regime, the Additional Child Care Subsidy (child wellbeing) will provide targeted additional fee assistance to families and children facing barriers in accessing affordable child care.

The Additional Child Care Subsidy (ACCS) replaces the Special Child Care Benefit (SCCB), the Grandparent Child Care Benefit (GCCB) and the Jobs Education and Training Child Care Fee Assistance (JETCCFAA).

Service providers are centrally involved in making applications for the Additional Child Care Subsidy (ACCS) where it applies to child wellbeing.

All other scenarios must be applied for through the family's engagement with Centrelink.

How to apply for the Additional Child Care Subsidy (ACCS) (child wellbeing)

STEP 1

Identify child at risk of serious abuse of neglect

STEP 2

Service provider gives an ACCS certificate

STEP 3

Service provider applies for a Determination

STEP 4

Service provider evaluates if an additional Determination is required and reapplies as needed.

STEP 1

A child is taken to be “at risk of serious abuse or neglect” if the child is at risk of experiencing harm*, as a result of current or past circumstances or events that resulted in the child being subject to, or exposed to:

- serious physical, emotional or psychological abuse

- sexual abuse

- domestic or family violence or

- neglect*

This also applies to possible future situations and to children deemed “at risk” under child protection law.

* See definitions in Draft New Child Care Subsidy Handbook

STEP 2 - Give an ACCS certificate

- On identifying that child is at risk, service provider may give a certificate for 6 weeks

- Automatically triggers 6 weeks of payment

- No other evidence required

- Must give notice within 6 weeks

- Apply through third party software or Provider Entry Point

- Require details of child; a high level description of which children are eligible; the period of time (up to 6 weeks) the certificate is given for; details of the body which has been given notice*; a declaration that the information is true and correct

- Certificate commences on a Monday; can be backdated for 28 days, but cannot commence after the day it is given

- If a child has already been given a previous certificate, Provider must apply for a determination

- No need to provide evidence, but keep supporting documentation (eg staff observations)

- Certificate can be reviewed and cancelled

- Provider must notify the appropriate state/territory body within first 6 weeks of giving a certificate

- Provider must notify the appropriate state/territory body within first 6 weeks of giving a certificate

- If the child has been referred to the child care service by a child protection agency, further notice is not required

- Providing notice to an appropriate state/territory body does not override obligation to formally notify of mandatory reporting cases

- Details of the notice to an appropriate state or territory body can be provided (using third party software or the Provider Entry Point) at any time from when the certificate is given.

- Details of this notice will need to be provided before an application for an Additional Child Care Subsidy (child wellbeing) Determination can be submitted.

Organisations can be considered appropriate state/territory bodies if:

- they are a state or territory department or agency

- they are funded or part-funded by the state or territory

- they are otherwise supported or endorsed by the state or territory

- they fulfil a role that would otherwise be taken by the state or territory.

Full details of examples of organisations can be found in the Draft Handbook but other examples include:

-

Parenting assistance including Family Support Programs

- Interpersonal conflict/ separation/ mediation services

- Child and maternal health services, including antenatal services

- Drug or alcohol or substance abuse services or gambling services

- Community health services

- Financial counselling services

- Aboriginal and Torres Strait Islander health and support services

STEP 3 - Apply to the Department of Human Service (DHS) for a Determination to continue the subsidy

- If continuing risk

- For up to 13 weeks more

- Need to provide 3rd party evidence

- Evidence to support a determination will be required

- An application for a determination can be made before the Certificate expires. To ensure continuity of payments it will be beneficial to apply early.

- No application is needed for further periods – the provider will receive a notification four weeks before each determination expires, which asks whether the child’s circumstances have changed or remain the same. If the child remains at risk and the Additional Child Care Subsidy (child wellbeing) should be extended, the provider should respond as such. Evidence must be provided for each period before the extension can be approved

- New evidence does not necessarily need to be provided for each period of Additional Child Care Subsidy (child wellbeing).

Evidence

Evidence should show that the child is at risk of serious abuse or neglect and specify the type of abuse where applicable.

Where possible, evidence should indicate how long the child is likely to be at risk. Evidence should not be older than six months.Evidence should show that the child is at risk of serious abuse or neglect and specify the type of abuse where applicable. Where possible, evidence should indicate how long the child is likely to be at risk. Evidence should not be older than six months.

Evidence may include a:

- written statement from a child protection agency that a case of abuse or neglect has been substantiated (this alone is sufficient evidence)

- letter from the state/territory body which was notified during the six week period

- letter and case plan from a relevant professional (e.g. doctor, psychologist etc)

Generally, the evidence must allow the assessing officer to determine if the child meets the definition of ‘at risk of serious abuse or neglect’ in the relevant Minister’s Rule

STEP 4

Assess the situation to evaluate if an additional Determination is required and reapply where deemed appropriate.

The 50% rule

Services cannot have more than 50% of ACCS enrolled children on any one day in their early learning environment.

The ACCS pays on any one day*

Pays 100% of fee charged- up to 120% of hourly rate cap for up to 100 per fortnight

No income or activity test applies

* there are exemptions applicable

The Department of Education and Training has produced a Family Transition Flowchart available pdf here, which includes the steps for families currently receiving the Special Child Care Benefit (SCCB) who wish to apply for the Additional Child Care Subsidy (ACCS).

For more information visit the Department of Education and Training website and read their Frequently Asked Questions (click on the the "Additional Child Care Subsidy" heading).

Families should contact Centrelink directly if they wish to apply for the Grandparents, Temporary Financial Hardship or Transition to Work categories of the Additional Child Care Subsidy.

Families should contact Centrelink directly if they wish to apply for the Grandparents, Temporary Financial Hardship or Transition to Work categories of the Additional Child Care Subsidy.